On June 20, 1921 – just four days short of a year since Will’s death – Clara filed the very last of the required probate paperwork with the Saunders County Court. She had paid off all the creditors, thanks to a loan of $7,000 from her parents. She still held title to the farm, but there was a mortgage of $8,000 against it. She had a home to live in, her children by her side, and the necessary livestock and equipment to continue the family farm operation.

I have some of her papers from the 1920’s that give a little indication of how the family’s finances evolved.

I have several promissory notes for the period 1921-1925. Most of these were either due on demand or at a stated period of six months. I think Clara re-paid all of these each year and in fact, I have the cancelled check for the payment of the last three notes for 1924 (she paid them off in February of 1925).

| Year | Amount |

| 1921 | $ 250.00 250.00 30.00 |

| 1922 | $ 200.00 200.00 100.00 118.27 |

| 1923 | $ 450.00 100.00 |

| 1924 | $ 400.00 98.92 400.00 250.00 200.00 |

These seem like the typical short-term notes that are sometimes needed for farm operations – money borrowed for seed, for example, that is paid back after harvest.

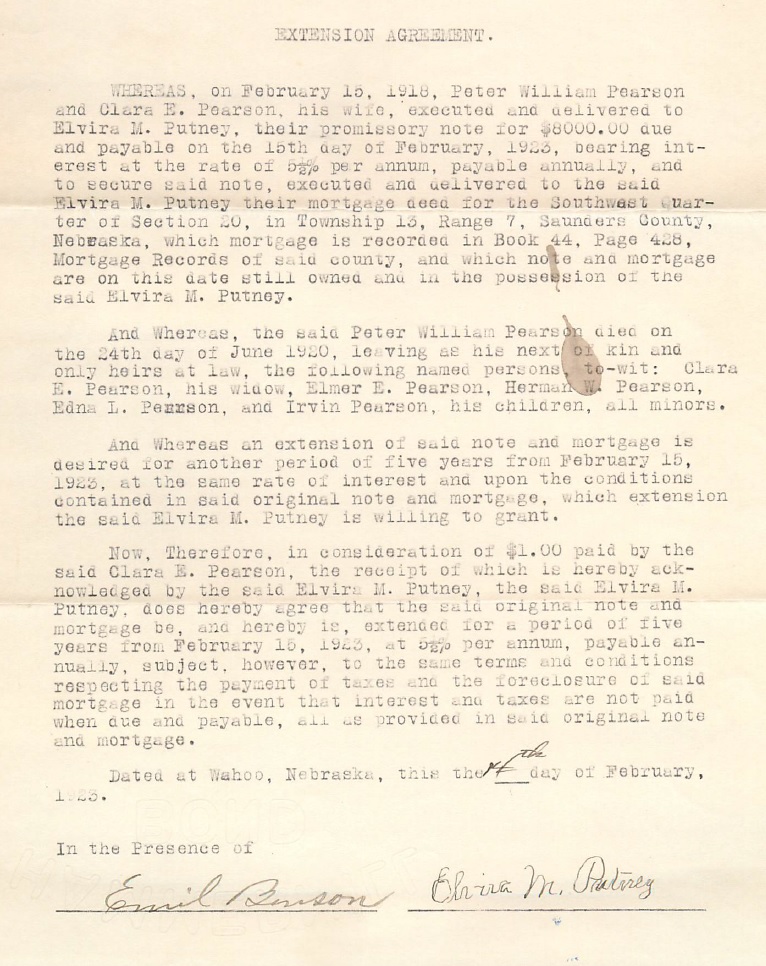

Clara did have one huge issue looming on the horizon after Will’s death: the mortgage would come due in 1923. I’ve done some more reading on how mortgages worked back in this era. There was no such thing as a 30-year loan. Almost all mortgages were for terms of five years and were interest-only with essentially a giant balloon payment at the end. I guess your strategy as a borrower would be to acquire whatever capital you could during the term of the mortgage. When the mortgage came due, you might pay it off with a combination of your accumulated cash plus the proceeds of another five-year mortgage. Will and Clara’s problem was that they never got ahead. I have records of them borrowing the same $8,000 in 1907, 1913, and 1918.

Their original mortgage was carried by the previous owner, Gus Larson. The 1913 and 1918 mortgages were carried by Mrs. Elvira Putney, a wealthy widow in Wahoo. Another thing I learned was that a lot of mortgages of this era were based on who you knew. There was no such thing as a credit rating or a credit check! I’m guessing that the bank in Wahoo acted as a go-between for the Pearsons and Mrs. Putney: they had a customer (Mrs. Putney) with money to lend and another customer (Will) who they could recommend as a reliable borrower.

So when 1923 rolls around, Clara is in dire need of getting another mortgage. Would the bank continue to recommend her to Mrs. Putney? Would there be anyone else in the community who would consider lending money to a widow in such a precarious circumstance?

I have the answer in my files:

So its seems that Mrs. Putney was convinced to extend the mortgage for another five-year period with the same terms. This must have been a huge relief to Clara. Perhaps it was lucky that they had borrowed money from a widow, as surely Mrs. Putney had some empathy for Clara’s situation.

Just 10 months later, however, 78-year-old Elvira Griffey Putney died. Settling her estate probably involved calling in her debts – mortgages of this era could be called in on demand!

What rabbit can Clara pull out of her hat this time around?

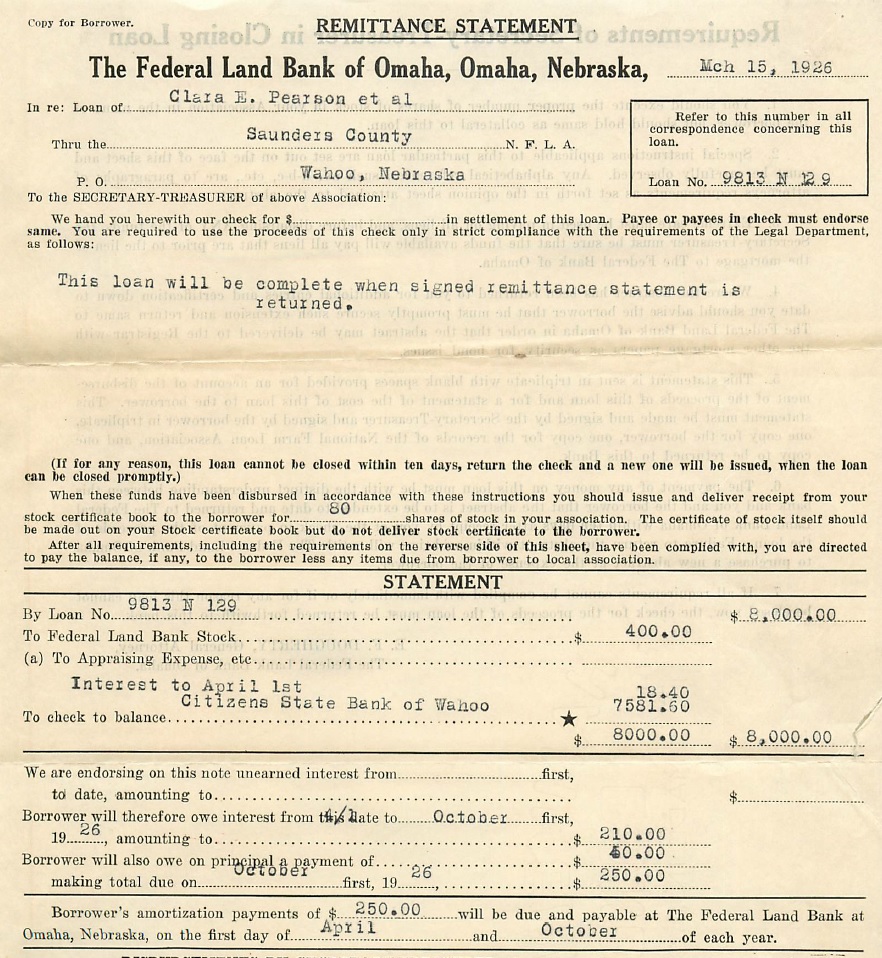

Think what you will about government, this is an example of a time when the federal government did some really good things for honest and hard-working Americans. The Federal Land Bank of Omaha was one of 12 regional centers formed in 1923 for the purpose of lending money to people like Clara. I have a copy of her loan settlement paper. She is again borrowing the same $8,000, but this time she’s borrowing against the full faith and credit of the U.S. Government, not from a kindly widow lady. Plus, her semi-annual payments of $250 each includes a small amount of principal. So she will FINALLY start making headway against the $8,000 debt.

The term of the loan isn’t stated, but I have other documents in the file showing that she closed out a loan in 1931 – suggesting that this was another 5- year arrangement (it would be several more years before the 30-year mortgage term comes into vogue). I think she continued to secure federal financing for this debt until it was fully retired – more about that another time.

So good news for Clara on the mortgage thing. What about the loan from her parents? We’ll look at that next time.

Here’s a grainy picture of Clara and her kids taken in probably 1927 or 1928. Perhaps Elmer’s bride (or bride-to-be) Sophia is behind the camera. This time everyone is smiling and happy.